Estate and Inheritance Tax Planning

Inheritance tax must be paid by your loved ones before your assets can be released to them. Your assets comprise of your home, savings and investments including ISA’s and insurance policies not placed under trust.

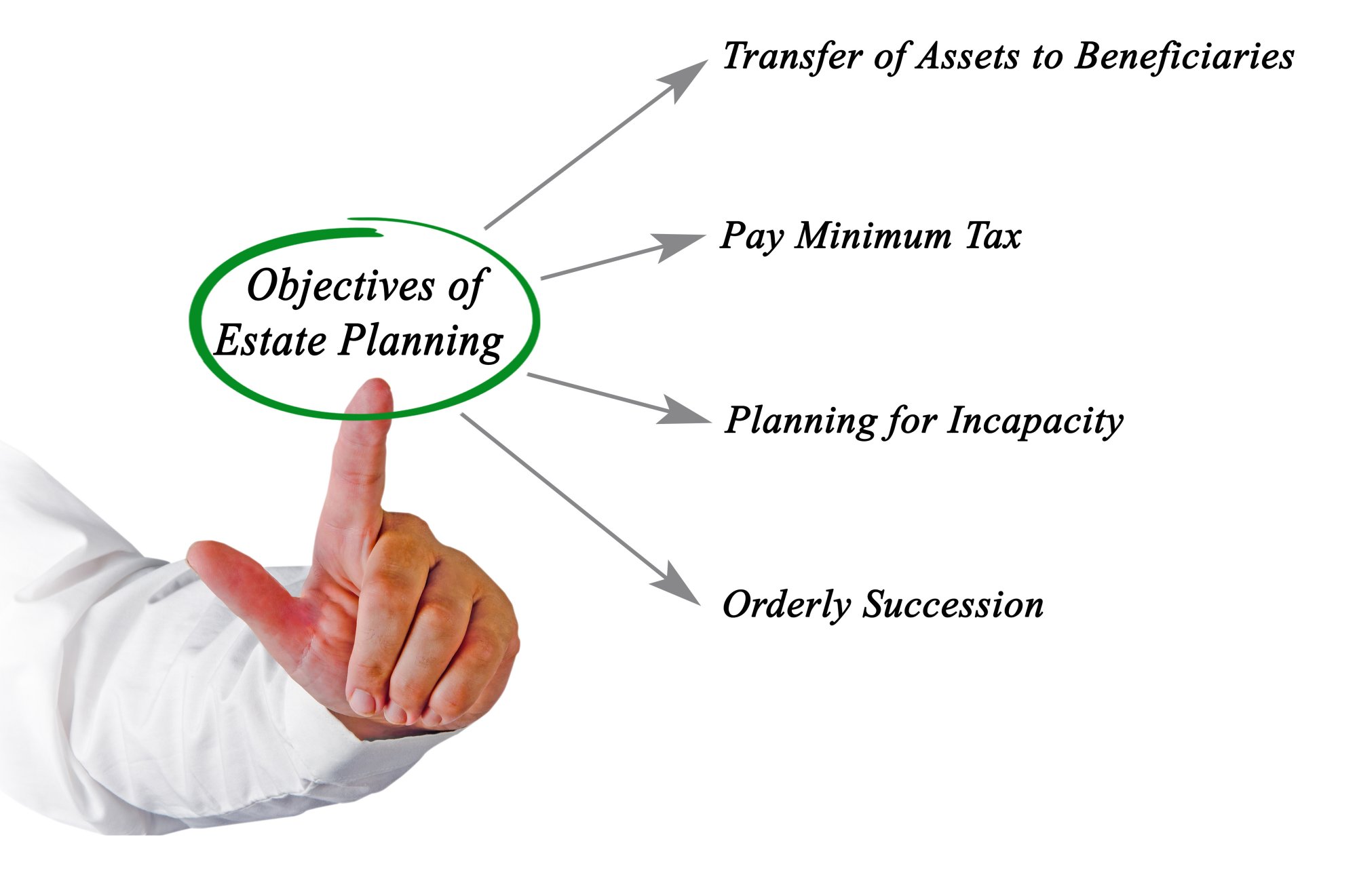

There are a number of ways to manage and distribute wealth to reduce an inheritance tax liability.

- Outfight Gifts

- Structuring your will

- Reliefs

- Trusts

- Investments

Business Property Relief (BPR)

Business Property Relief (BPR) has been an integral part of inheritance tax planning since the 1970’s. Investing in the shares of BPR qualifying shares can be beneficial if you want your money to become inheritance tax exempt quickly. Once BPR qualifying shares have been held for at least 2 years, they can be passed on free from inheritance tax on the death of the shareholder. BPR investments can also be suitable for those investors who do not want to give away their wealth. You can also hold AIM listed shares in an individual ISA. There are risks associated with these types of investments and the value of your investment can go down as well as up.

Trusts and Gifting

The Order of Gifting is imperative to get right as gifting in the wrong order can have significant tax issues. It is therefore essential to assess the entirety of assets and any previous gifts made and in the order they were made. Both onshore and offshore investments can be considered and are often instrumental for inheritance tax planning. There are a number of trust options available which can be utilised to tailor the investment to meet your objectives. Trust and gifts give limited or no access to your wealth and you must survive for 7 years for the gift to pass outside of your estate for inheritance tax purposes. There are also risks associated with these types of investments and the value of your investment can go down as well as up.

Disclaimer: The Financial Conduct Authority does not regulate tax planning. To find out more, click here.